The US is steadily moving towards the adoption of clean energy generation and its integration into the grid. In particular, New York is working rigorously towards achieving its clean energy targets set by the Climate Leadership and Community Protection Act (CLCPA), which requires state-wide greenhouse gas (GHG) emissions to be 40 per cent lower than the 1990 levels by 2030 and 85 per cent lower by 2050. The state also has plans to develop 9,000 MW of offshore wind (OSW) by 2035.

To achieve the most aggressive climate policy legislation in the country through the CLCPA, the New York Public Service Commission (NYPSC) recognised that the state’s transmission and distribution (T&D) infrastructure required restructuring and repurposing, for which the State Governor introduced the Accelerated Renewable Energy Growth and Community Benefit (AREGCB) Act in April 2020. The AREGCB Act distinguishes between distribution, local transmission and bulk transmission assets. Herein, local transmission is referred to as transmission lines and substations that generally serve local load and transmission lines to transfer power to other service territories and operate at less than 200 kV. Whereas, the bulk power transmission facilities (BPTF) are planned and operated by the New York Independent System Operator (NYISO), pursuant to its tariff approved by the Federal Energy Regulatory Commission (FERC).

The AREGCB Act directs the identification of distribution system upgrades, local transmission upgrades, and investments in the bulk transmission system as necessary to achieve the CLCPA targets. In this context, the Act required NYPSC to establish a planning process to guide future investments in local transmission and distribution (LT&D) and establish a LT&D capital plan for each utility.

Owing to this, on November 2, 2020 New York’s investor-owned utilities (IOUs) jointly filed a report on T&D investment in New York. The IOUs—Avangrid subsidiaries New York State Electric and Gas (NYSEG) Corporation and Rochester Gas & Electric (RG&E) Corporation, Central Hudson Electric and Gas Corporation, Consolidated Edison Company of New York Inc. (CECONY), Long Island Power Authority (LIPA) and Orange and Rockland (O&R) Utilities, and National Grid subsidiary Niagara Mohawk Power—have collectively incorporated their proposals and recommendations in the report.

The report summarises the recommendations by the IOUs regarding incorporation of regulatory changes, predictive LT&D upgrades and technological advancements to be made to alleviate transmission system bottlenecks. Key takeaways from the report are as follows:

Categorising local transmission and distribution projects

The recommendations made by the IOUs in the Working Group Report consider two categories of LT&D projects based on project readiness and the complexity of regulatory issues that remain to be resolved:

- Phase 1 projects are immediately actionable projects that satisfy reliability, safety and compliance purposes but can also address bottlenecks or constraints that limit the delivery of RE within a utility’s system. Phase 1 projects will be financially supported by the customers of the utility proposing the project. These projects may be in addition to projects that have been approved as part of the utility’s most recent rate plan or are in the utility’s current capital pipeline.

- Phase 2 projects may increase capacity on the local transmission and distribution system to allow for interconnection and delivery of new renewable generation resources within the utility’s system. These projects are not currently in the utility’s capital plans and are identified as needed to achieve CLCPA statutory requirements.

Additionally, it has been recognised that achieving the requirements of the CLCPA and the AREGCB Act will also require changes to existing practices concerning cost allocation and cost recovery of projects.

Regulatory recommendations by the IOUs

The proposals and recommendations by the IOUs for various regulatory considerations include the following:

CLCPA Investment Criteria and Project Prioritisation

The utilities recommend a set of LT&D investment criteria that will be designed to meet CLCPA targets:

- Cost effectiveness of local transmission and distribution investments;

- greater RE utilisation (in an attempt to reduce curtailments and increase renewable power delivery to New York customers);

- streamlined RE project deployments to deliver benefits more quickly;

- system expandability to interconnect renewable generation;

- improved system flexibility to manage intermittent resources; and

- firmness of renewable generation projects that would be facilitated by the proposed local transmission and distribution investments.

The use of these criteria will allow the IOUs to identify CLCPA-driven projects along with traditional reliability, safety and compliance projects. Going forward, the utilities recommend that these approaches should be integrated with existing LT&D planning processes.

Benefit Cost Analysis (BCA)

The utilities recommend that the NYPSC accept a set of local transmission-related BCA guidelines for CLCPA projects. These guidelines will comprise a simple and consistent mechanism to allow local transmission owners to prioritise CLCPA-related investments.

Stakeholder Engagement

The utilities recommend annual engagement with stakeholders via robust dialogue and data exchange as a supplement to existing mechanisms that provide transparency in T&D planning. The recommended stakeholder engagement opportunities specific to local transmission planning would be conducted by each New York jurisdictional utility.

Cost Allocation and Cost Recovery

It is anticipated that incorporating an increasing share of renewables into LT&D activities will entail additional costs. It is therefore imperative to draw clear cost allocation and recovery processes to ensure timely implementation and cost-effective project deployment. For this, the utilities propose the following:

- Cost-sharing measures should not impede project development.

- Beneficiaries must include all customers throughout the state to ensure equitable cost allocation.

- The incremental cost of utility projects prioritised to support CLCPA mandates should be eligible for load ratio share cost allocations.

- The NYPSC should determine the local projects for which costs should be shared and for which they should not, while also recognising regional planning projects that benefit a region and are also needed to facilitate CLCPA mandates. The utilities further recommended that the NYPSC should track individual utility CLCPA project costs and consider whether costs are incurred equitably across the state when determining the need for cost sharing.

- NYPSC should authorise project cost recovery, outside of rate case processes, to expedite CLCPA projects.

- Uilities must have certainty on cost allocation and recovery before projects can begin.

Suggested LT&D upgrades

The report further identifies several potential LT&D upgrades suggested by the utilities as necessary to expedite the achievement of the CLCPA RE mandates. These include both immediately actionable local system upgrades (i.e. new facilities or enhancements to existing transmission or distribution facilities) and future potential upgrades (on a need-basis to achieve CLCPA targets), which will facilitate greater interconnection and use of clean energy resources throughout the state.

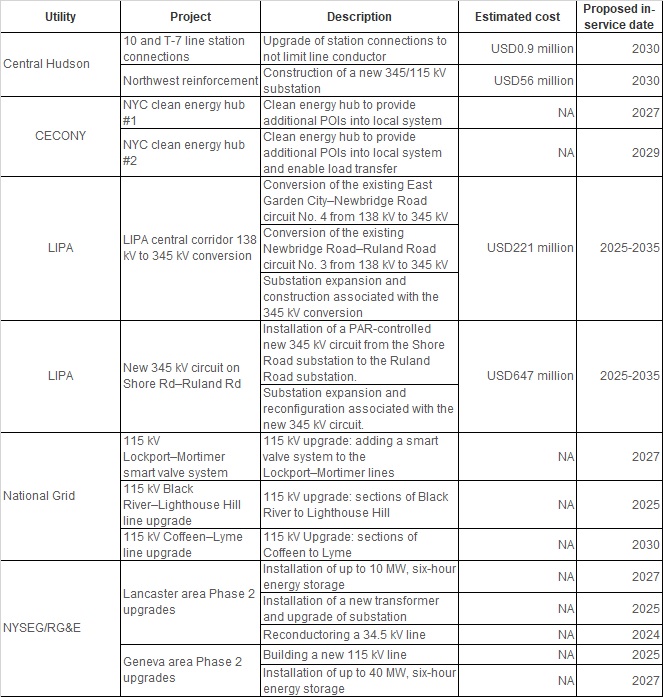

The proposed Phase I and Phase II local transmission upgrades by the utilities are given in the tables below.

Note: NA – not available; CECONY – Consolidated Edison Company of New York Inc.; LIPA – Long Island Power Authority; NYSEG – New York State Electric and Gas Corporation; RG&E – Rochester Gas & Electric Corporation; O&R – Orange and Rockland utilities.

Source: Utility Transmission and Distribution Investment Working Group Report, 2020

Note: NA – not available; POI-points of interconnection; CECONY – Consolidated Edison Company of New York Inc.; LIPA – Long Island Power Authority; NYSEG – New York State Electric and Gas Corporation; RG&E – Rochester Gas & Electric Corporation; O&R – Orange and Rockland utilities.

Source: Utility Transmission and Distribution Investment Working Group Report, 2020

Note: NA – not available; CECONY – Consolidated Edison Company of New York Inc.; LIPA – Long Island Power Authority; NYSEG – New York State Electric and Gas Corporation; RG&E – Rochester Gas & Electric Corporation; O&R – Orange and Rockland utilities. *MW benefits for Phase I projects have been provided as an indicator of the relative benefit of each project. Once the BCA methodology is approved, the utilities will work to update this metric for Phase 2 projects.

Source: Utility Transmission and Distribution Investment Working Group Report, 2020

Technological advancements

The Advanced Technologies Working Group (ATWG) is facilitating the development of plans for the Utility Transmission and Distribution Investment Working Group, to further the goals of the CLCPA by considering roles and opportunities for grid investments in advanced technologies. The ATWG has prioritised several issues that need to be addressed, such as:

- alleviating transmission system bottlenecks to allow for better deliverability of RE throughout the state;

- unbottling constrained resources, allowing more hydro and/or wind imports and reducing system congestion;

- optimising the use of existing transmission capacity and rights-of-way (RoW); and

- increasing circuit load factor through dynamic ratings.

In response to these issues, the ATWG recommended potential technology solutions, as follows:

- A New York research and development (R&D) consortium should be created to initially identify two to three R&D projects, preferably one project for each of the three technology solutions: dynamic line ratings, power flow control devices, and energy storage for T&D services. These initial projects should demonstrate the use and benefits of the selected technologies.

- The R&D consortium will initially include all the New York State IOUs, New York Power Authority (NYPA), LIPA, the NYISO and New York State Energy Research and Development Authority (NYSERDA) and may be expanded over time to include academic institutions.

- The projects proposed should be evaluated based on their potential benefits and costs and should also be risk-adjusted based on their likelihood of success.

- Projects selected by the R&D consortium should be funded through NYSERDA, with the IOUs, NYPA and LIPA participating in the project having the opportunity to support the project through co-funding or in-kind contribution on a project-by-project basis.

- The R&D consortium will further investigate specific needs, capabilities and plans for the establishment of a collaborative R&D and testing venue; and assess existing resources in New York that could be utilised as part of the evaluation of new or future advanced technologies.

Further, suggestions for technological solutions that can be deployed include the use of transformer, cable and transmission line monitoring systems; advanced transmission and sub-transmission voltage regulation systems; energy storage for grid services; advanced high temperature low sag (HTLS) conductors; global information system utilisation; and improved ability of transmission lines to redirect flow to underused lines.

Conclusion

The report filed by the IOUs highlights the key issues in integrating RE resources into the state grid and the possible measures that can be adopted to address these issues in order to achieve CLCPA targets. In particular, regulatory considerations need to be designed and implemented such as a CLCPA investment criteria and basis of project prioritisation. Further, employing the use of local transmission-related BCA guidelines for CLCPA projects, robust engagement with stakeholders and drawing clear cost allocation and recovery processes will also lead to timely execution of projects. R&D on technological advancements is key to effectively optimise grid investments, allowing for better deliverability of RE throughout the state.

Each utility has incorporated its immediately actionable (Phase I) and proposed/conceptual (Phase II) local transmission upgrade projects, which can facilitate unbottling of constrained resources and achieve CLCPA objectives in a cost-effective manner.

In all, the utilities estimate about USD4,164 million worth of local transmission upgrades for Phase I projects, which would result in an approximately 6,619 MW benefit, and about USD7,620 million for Phase II upgrades, resulting in a 12,725 MW benefit.

The article has been sourced from Global Transmission and can be accessed by clicking here