This International Council on Clean Transportation briefing evaluates the U.S. position in the emerging global light-duty electric vehicle industry. The briefing analyzes U.S. vehicle manufacturing plants and automaker commitments to transitioning to electric vehicle production and compares these developments with those happening globally. REGlobal presents an extract from this report.

National governments such as Canada’s, France’s, Germany’s, the Netherlands’, Norway’s, Spain’s, and the United Kingdom’s have declared plans to switch to all-electric car sales between 2025 and 2050. Governments are setting clear objectives and adopting different legislative, consumer, and industry strategies to remove the hurdles to mass adoption in order to speed up the transition to electric.

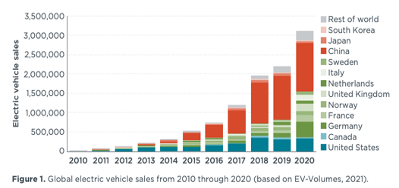

By 2020, the global stock of electric passenger vehicles will have reached 10 million. The figure depicts the global rise of electric car sales from 2010 to 2020, from a few thousand in 2010 to more than 3.1 million in 2020. Moreover, electric cars accounted for around 4.2 percent of all new passenger vehicles sold globally, including both battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV).

The necessity for a stable climate, decreased fuel costs, reduced petroleum dependency, and clean air, especially for those who are disproportionately affected by pollution, definitely acts as factors that motivate governments to move to electric cars. Major economies with significant car production, such as China, Japan, Germany, the United States, and others, suffer the biggest industry risk if they delay the transition to electric vehicles. In a related development, the Biden administration’s American Jobs Plan proposes $52 billion in U.S. assistance for domestic manufacturing, including tax incentives and access to financing.

The global sales and production trends of electric vehicles give an important introduction to the growing market dynamics. The graph depicts cumulative electric vehicle sales and production in China, Europe, the United States, Japan, and South Korea from 2010 to 2020. These five areas account for around 97 percent of electric car sales and 98 percent of manufacturing.

China is the world’s leading producer of electric vehicles, accounting for about 44% of global production and sales of 4.6 million vehicles by 2020. Europe comes in second, accounting for 25% of worldwide electric vehicle manufacturing, with 2.6 million cars manufactured and 3.2 million sold, making it a net importer. The United States now accounts for roughly 18% of total worldwide electric car manufacturing, down from 20% in 2017. In terms of yearly production in 2020, the United States produced over 450,000 electric vehicles, with Tesla accounting for around 85% of the total, while annual electric vehicle exports topped 215,000, the most of any country.

The sales and production dynamics of electric vehicles have consequences for where and when car manufacturers make the switch to electric vehicles. The majority of electric cars are built in the same location where they are marketed. Eighty percent of the 10 million electric cars delivered between now and 2020 will be sold in the region where they were built. In 2020, the global average percentage of new light-duty cars that were electrified was 4.2 percent. European sales surpassed this by a factor of ten with a share of ten percent, China surpassed it by a factor of six with a share of six percent, the United States trailed at 2.3 percent, South Korea trailed at 2.2 percent, and Japan trailed at 0.8 percent.

Many businesses, including Ford, GM, Tesla, and Volkswagen, have boosted their expenditures in electric car production after December 2020. With hundreds of billions of dollars in electric car expenditures expected before 2030, major issues regarding which locations and production facilities automakers will spend remain unanswered.

Global EV Manufacturing Development

This graph depicts the anticipated worldwide light-duty vehicle production in 2025 for 14 major automakers with at least one assembly facility in the United States. Companies are listed from top to bottom in order of highest projected production volume in 2025, ranging from around 11 million cars (Volkswagen Group) to approximately 750,000 vehicles (Volvo).

The 14 automakers mentioned in the figure are expected to produce roughly 68 million light-duty vehicles in 2025. The United States accounts for around 16% of the manufacturing output of these companies. Electric cars account for around 20% of the light-duty vehicle manufacturing indicated. In 2025, electric cars made in the United States would account for around 10% of worldwide light-duty electric vehicle production. By 2025, electric car manufacturing at all-electric plants in China and Europe would account for around 40% of worldwide light-duty electric vehicle production.

The figure’s very small representation of all-electric US facilities reflects lower levels of investment in the US. According to official declarations, only General Motors and Tesla will have all-electric factories in the United States by 2025. Toyota, Honda, Ford, and Fiat Chrysler stand out with four to six US combustion car facilities, each having an annual capacity of more than one million vehicles, but no all-electric plants have been declared. Ford, Nissan, Fiat Chrysler, Mercedes-Benz, BMW, Hyundai, Volkswagen, and Volvo have produced some electric cars or invested in expanding their ability to do so, but they have not committed to all-electric assembly plants in the United States. Ford manufactures the electric Mustang Mach-E in Mexico and plans to manufacture other electric models in Canada. In Canada, Fiat Chrysler also produces the plug-in hybrid Chrysler Pacifica.

As seen in the previous figure, no major automakers have announced new electric car manufacturing sites, however some are attempting to convert or expand existing combustion vehicle manufacturing facilities to produce electric vehicles. Since these factories will build both combustion and electric cars, the majority of the investment is likely to go toward increasing the capacity for electric vehicle and battery assembly. Figure 4 shows the projected 2025 light-duty vehicle output for the same 44 U.S. assembly facilities that are displayed, with the exception of Fiat Chrysler’s Mack Avenue facility, which is being converted from an engine plant to a vehicle assembly plant.

In 2025, the total production for the manufacturers is shown to be around 10.6 million light-duty cars. Assuming full conversion of three General Motors facilities plus the additional plants proposed by Tesla, Rivian, and Lucid Motors, electric cars would account for at least 16% of total U.S. output. Tesla and General Motors are expected to produce the most electric vehicles by 2025, with around 600,000 and 500,000 vehicles, respectively. Tesla manufactures only electric automobiles. Based on the announced full conversion of three factories, electric vehicles will account for around 30 percent of General Motors’ anticipated 1.6 million vehicle output in the United States by 2025.

With no declared all-electric car assembly factories, high-volume firms Fiat Chrysler, Toyota, Honda, and Nissan stand out in the United States, producing between 800,000 and 1.5 million light-duty vehicles yearly. Subaru, Hyundai, and Kia, for example, each have one combustion-only facility and no electric car factories.

The combined yearly production capacity of all 43 light-duty vehicle assembly factories in 2025 is 14 million. The Midwest and South have the majority of the factories and manufacturing capability. About 55% of US production capacity and 60% of assembly facilities are concentrated in five states: Michigan, Indiana, Alabama, Ohio, and Illinois.

The South has 18 assembly plants, the Midwest has 23, and the West has two. Michigan has the highest yearly manufacturing capacity, at 2.7 million, and is home to ten of the 43 assembly factories depicted, including Fiat Chrysler’s Mack Avenue facility. It is home to two GM facilities, Detroit-Hamtramck and Orion, which are being transformed to solely produce electric vehicles.

Policy Context

To promote the growth and expansion of domestic electric vehicle production, demand-side policies that increase interest and eliminate consumer hurdles, as well as supply-side policies that stimulate the manufacturing industry, are important. Automakers focus their electric car deployment and support operations largely on big markets with legislative and consumer-support policies. China and Europe have continued to drive electric car market and assembly growth through long-term and comprehensive regulatory, consumer incentive, and industrial strategies, but the United States has reduced vehicle restrictions.

Several remarks from the car industry show how automakers favour markets with zero-emission vehicle (ZEV) legislation changes. China has the most complete ZEV policy package, including aggressive market growth and industry support measures. A similar tendency can be seen in Europe, where industrial investments and market developments are picking up speed. In Europe, reported electric vehicle and battery investments totaled 60 billion euros in 2019, an increase of more than 19% over 2018.

In terms of market development, Europe’s electric vehicle market exceeded China’s for the first time in 2020, both in terms of new electric car sales and market share. These recent changes are the outcome of tighter regulatory measures in Europe as well as diminishing incentives in China. The worldwide electric car transition is underway, with automakers investing hundreds of billions of dollars to assist the move to electric vehicles. These investments offer a fantastic chance for countries all over the world to gain economically from the growth of car production.

The majority of electric car deployment and investment is going to markets other than the United States, mainly China and Europe. Toyota, for example, is investing $1.2 billion with FAW and creating an electric car joint venture with BYD in China, but no electric vehicle production plans have been revealed in the United States. General Motors has a joint venture with SAIC and Wuling (which has the best-selling electric model in China) and will offer nine electric car types in China by 2020, compared to one in the US. Ford has stated that all of its European models would be plug-in electric by mid-2026 and all-electric by 2030, but has made no comparable promises for the United States. Additional company statements highlight the significance of policy in manufacturers’ electric car operations. According to Fiat Chrysler’s annual report, regulatory measures are a major motivator for the company’s compliance-focused car sales strategies per area. From 2018 to 2019, the company’s electric car sales strategy altered; Fiat Chrysler raised its electric vehicle aspirations in China while decreasing its objectives in the U.S.

Conclusion

The United States is the third largest manufacturer of electric vehicles, after only China and Europe, and the gap is growing. From 2017 to 2020, the United States’ share of total worldwide electric car manufacturing since 2010 fell from 20% to 18%. In comparison, China has grown its production of electric cars at a higher rate, accounting for 44 percent of global electric vehicle production until 2020, up from 36 percent in 2017. Similarly, European manufacturing accounts for 25% of global electric car production by 2020, up from 23% in 2017. In terms of annual electric vehicle production, Europe’s 1.1 million roughly matched China’s 1.27 million in 2020, followed by 450,000 in the United States and around 110,000 in Japan and South Korea.

Eighty percent of the 10 million total electric cars sold globally were manufactured in the same location where they were sold. From 2018 to 2020, the U.S. market remained stable, with fewer than 360,000 electric car sales per year, but Europe witnessed exponential growth from 390,000 to more than 1.3 million, and China expanded from around 1 million to more than 1.25 million. These patterns are a result of recent policy changes. To fulfil car CO2 emission regulations, automakers in Europe introduced 30 new models with greater volume. China has the most extensive system of demand- and supply-side policies, and it has expanded consumer incentives and is enacting stricter rules for electric vehicles. Vehicle restrictions have been relaxed in the United States, and incentives have not been extended.

The majority of automakers’ electric car pledges and investments are aimed at China and Europe. Approximately 15% of the $345 billion worldwide manufacturer electric vehicle investments appear to be headed for the United States. According to corporate announcements through 2020, around 5% of this worldwide total is actively being spent in specific U.S. assembly sites to enhance electric car production. Similarly, of the 22 million annual electric car sales announced by manufacturers by 2025, around 2.3 million (or about 10%) are expected to be built in the United States. In China and Europe, global manufacturers have made increasingly significant commitments to electric vehicles. About a quarter of General Motors’ $35 billion electric car investment is being spent in particular vehicle assembly and battery sites in the United States. Ford has promised to produce an all-electric option for every model it sells in Europe by 2030, but has made no equivalent pledges in the United States, and only around 6% of its $30 billion investment in electric vehicles is actively being made in particular U.S. facilities.

By 2025, seven of the 44 main car assembly facilities in the United States are expected to produce fully electric vehicles. According to corporate declarations and industry trends, seven of the 44 main U.S. assembly facilities, accounting for approximately 16% of U.S. vehicle production and capacity, will build solely electric vehicles by 2025. In 2025, the United States’ vehicle production and capacity will be limited to electric cars. Three of the electric plants in the United States are owned by General Motors, two by Tesla, and one each by Rivian and Lucid Motors, two developing electric car startups. Five manufacturers (Ford, Fiat Chrysler, Toyota, Honda, and Nissan), each of which produces between 900,000 and 1.5 million vehicles per year, have not declared plans for electric vehicle-only assembly factories.

Many automakers, however, have established limited capacity for certain electric car manufacturing (usually less than 15% of a plant’s production capacity by 2020) and are making significant investments to partially convert or increase their electric vehicle capacity. Electric car production grows in areas where regulations encourage the expansion of electric vehicles. The dynamics of electric car manufacturing indicate where the biggest electric vehicle market growth has occurred, which is highly influenced by legislative developments. Countries are competing globally to capitalise on the economic benefits of the shift to electric cars. Despite the fact that the United States will lag until 2020, major automakers look to be well-positioned to transition provided policy signals are sent in the correct direction.

The complete report can be accessed here