As the necessity of energy system transformation gathers pace at a global level, North African countries are increasingly making efforts towards their respective clean energy transitions. Clean energy transitions offer opportunities for North African countries to transform their energy infrastructure in ways that can meet the region’s growing energy demand, create much-needed jobs and promote equitable socio-economic development, diversify their economies, and build climate change resilience, all while achieving low-carbon, sustainable, inclusive economic growth. Decarbonisation pathways are also instrumental for North African countries to achieve their climate and economic development ambitions.

Against this backdrop International Energy Agency’s (IEA) recent report titled “Clean Energy Transitions in North Africa” identifies pathways and recommendations to accelerate clean energy transitions in five North African countries (Algeria, Egypt, Libya, Morocco and Tunisia). Its aim is to take stock of the region’s current energy trends and illustrate policy-relevant best practices that help advance decarbonisation of the region’s energy systems. The report highlights key policy recommendations and opportunities to enable policy makers to build future energy systems based on the deployment of clean, affordable and efficient energy sources and practices. Below are certain extracts from the report…

Regional overview

The five countries that span North Africa have significantly different circumstances that influence their energy transitions pathways. The region includes large hydrocarbon producers and exporters (Algeria, Egypt and Libya), as well as countries that are heavily dependent on imports to meet domestic energy demand (Egypt, Morocco and Tunisia). The socio-economic and political contexts also vary widely. While per capita income in Libya is more than 55% greater than the regional average, a prolonged period of political unrest and conflict means that service provision lags; Libya is the only country in the region that does not have universal access to electricity. Despite their differing contexts, all five countries share similar challenges when it comes to climate change.

The focus on transitioning to more sustainable energy systems has become an increasing priority for several North African countries, perhaps most notably Morocco, which set an example by enshrining sustainable development as a right for all its citizens in its 2011 constitution. There is considerable potential for improved sustainability across the region. Three countries, Algeria, Morocco and Tunisia, highlighted the role the energy sector could play in helping to meet their nationally determined contributions (NDCs) and have implemented measures to reduce the carbon intensity of their economies; and all five countries have established renewables targets. However, progress has been uneven and, in Libya, where the security situation is precarious, progress has been adversely affected.

North Africa’s generation mix is marked by its reliance on fossil fuels. Although the region has taken great strides to ensure access to modern clean energy, traditional biomass still plays a role in cooking in Algeria and Morocco. At 4.6% of the overall generation mix, renewables still play a small role that falls far below the global average of 25%. This is not commensurate with the available resources, as North Africa has some of the most favourable sites in the world for solar irradiance as well as significant wind potential in the coastal areas. North Africa has tremendous potential for increased renewables deployment, which could reduce dependence on imported fuels in Morocco and Tunisia while freeing up additional resources for export in Algeria. All five countries have long-term targets for increasing renewable electricity capacity. By 2030, Algeria targets 22 gigawatts (GW), Morocco 10 GW, Libya 4.6 GW and Tunisia 2.8 GW, while Egypt targets 54 GW by 2035.

Enhancing energy access

Access to energy services in modern households include two components: first, access to electricity, with 99% of the population reached across the region as early as the late 2000s, and second, access to clean cooking facilities, which is the case for 98% of North Africa’s population. North African countries reached quasi-universal access to electricity by 2010. Back in 2000, the average regional electrification rate reached 90% as urban households were provided access to electricity services across the region, but one-fifth of the region’s rural population remained without power. Subsequently, 15 million people gained access to electricity between 2000 and 2015, mostly in the rural areas of Egypt and Morocco. Today, these zones are still home to the region’s very last households without access to electricity. Meanwhile, a small share of the region’s population, mostly in rural areas, still relies primarily on traditional uses of biomass for cooking. This has negative impacts on human health and the environment due to poor indoor air quality and pollution, as well as on livelihood opportunity costs resulting from the time spent on fuel collection. North African households that remain without access to clean cooking are distributed across Algeria, Morocco and Tunisia, representing around 2% of the region’s population.

North Africa’s achievement of universal access to electricity is attributed to several factors. Lessons from North African countries confirm the need for government leadership; for adequate planning based on precise analyses of the situation; and for clear allocation of responsibilities at the national and local levels in order to gradually delivery electrification. Progress was realised through ambitious and well-designed public programmes and driven by the extension of national grid networks. To provide continuous access to clean cooking, governments have to ensure affordable and long-term fuel supply for a significant part of the population. Over the past decades, North African countries implemented ambitious policies to drastically reduce the traditional uses of biomass and ensure access to modern fuels for cooking by leveraging available cleaner solutions and fuels. Today, the vast majority of households in North Africa rely on either LPG or natural gas for cooking.

In past decades, energy access strategies in North Africa have been possible not only due to local resources such as natural gas and LPG but also thanks to public funding. The growth in consumption of both electricity and clean cooking fuels was supported by important subsidies, which have facilitated their affordability and enabled their wider uptake. While subsidies can help to support the uptake of energy services by the poorest households, they have also created substantial fiscal burdens for countries’ public budgets. Reforming fossil fuel subsidy schemes can be done by introducing appropriate pricing mechanisms and maintaining gradual assistance to the poorest households. To do so, assessing the impact on commercial, industrial customers and households is a prerequisite.

Another challenge in North Africa’s energy system is the reliability of power supply. Unreliable electricity is a constraint to the economy and to households in most countries. This has detrimental effects, including increased carbon emissions, poor air quality and lower economic competitiveness. Improving electricity quality and reliability by reducing losses would bring large efficiencies, benefiting company competitiveness and development. In addition, the adoption of efficiency standards could improve the affordability of electricity services. Strengthening the reliability of the grid and the affordability of electricity should remain a priority in North Africa and require significant investment. By 2025, USD 13 billion will be necessary on average each year to support new plants, refurbishments and network infrastructure.

Accelerating growth of renewables

Renewable energy consumption in North Africa remains largely untapped relative to its potential. In 2018, renewables accounted for 4.3% of final energy consumption, down almost two percentage points from the levels observed ten years prior in 2008 (6.0%). The decrease is due to both the declining use of traditional biomass use in Morocco and the upsurge in transport demand in Algeria and Egypt. Excluding traditional biomass use, the regional share of modern renewable energy in 2018 was 1.9%, but the shares vary significantly between countries ranging from less than 1% in Algeria to 7.6% in Morocco. The sector with the highest penetration of modern renewables in North Africa is electricity, where renewables accounted for 6.9% of supply in 2018. Penetration has been slower in heat and transport; where modern renewables accounted for only 1.4% and 0.03% respectively.

Renewables electricity capacity trends have grown in particular in wind and solar PV, especially in recent years (2009-19). Hydropower capacity has remained constant at around 5 GW. Wind capacity has grown rapidly over the period, rising to 2.9 GW by 2019 (all capacity on- rather than off-shore). In 2019, solar PV capacity reached 1.9 GW, and concentrated solar power (CSP) capacity rose sharply as projects in Morocco came online, reaching 0.6 GW. Bioenergy electricity generation capacity remained low at 70 megawatts (MW) (all in Egypt). Hydropower is the region’s largest source of renewable electricity, with more than 80% supplied by Egypt, followed by wind led by Morocco, Egypt and Tunisia.

Over the last decade, renewable electricity in North Africa has grown more than 40% due to the rapid expansion of wind, solar PV and solar thermal. Three-quarters of the region’s growth is from Morocco, driven by support policies targeting private investments such as competitive auctions among independent power producers (IPPs) and corporate power purchase agreements (PPAs). Almost 20% of Morocco’s electricity supply is from renewables, the highest penetration in the region. The rest of the growth is from Egypt, Algeria and Tunisia driven by a mix of procurement methods such as feed-in tariffs (FiTs); competitive auctions; unsolicited bilateral contracts; and utility engineering, procurement and construction contracts.

The largest amount of renewable capacity is from competitive bidding policies for long-term PPAs with state-owned utilities in Algeria, Egypt, Morocco and Tunisia. This policy accounts for almost half of the new capacity (5 GW) expected over the next four years for solar PV, onshore wind and CSP while at the same time helping to drive down costs in the region. In Morocco, IPP competitive auctions for CSP have decreased bid prices by 25% from USD 190 per megawatt-hour (MWh) for Noor I Ouarzazate (3.5 hours storage) in 2012 down to USD 140/MWh for Noor II (7 hours of storage) in 2015. Between 2016 and 2019, competitive auctions drove down solar PV bids from USD 49/MWh for Morocco’s Noor PV I to USD 24/MWh in Tunisia. More than half of the auctioned capacity will come from Morocco, largely due to a successful institutional framework using a public-private partnership through the Moroccan Agency for Sustainable Energy (MASEN). MASEN is a dedicated “one-stop shop” government institution that provides the land and infrastructure for the projects, organises the auctions, and provides the permitting. It also uses an innovative dual PPA procurement model to optimise risk allocation between the private and public players.

Key policy recommendations:

- Effective auction design is critical for de-risking investment and timely deployment. A transparent process is a must to attract investors and foster competition.

- Improved regulatory frameworks can also facilitate faster growth, particularly for distributed PV. Allowing grid access for small consumers through clear connection rules, harmonised permitting procedures and transparent grid codes, as well as establishing tariffs with fair remuneration of excess electricity sold to the grid, could accelerate investment.

- Implementing cost-reflective energy tariffs would also help improve the economic attractiveness of renewables. Reducing fuel subsidies may also help decrease the strain on national budgets. At the same time, any subsidy reduction or phase-out must be implemented very carefully in order to avoid excessive impacts on the most vulnerable parts of society.

- Participation of development banks remains crucial to decrease risk and increase bankability of large-scale projects. At the same time a greater involvement of local commercial banks is also needed, including by diversifying financing models and products and increasing the capacity of commercial banks to fund renewable energy projects.

Outlook for renewables: The IEA World Energy Outlook (WEO) has modelled the growth of renewables in the region to 2030 and beyond in two scenarios, the Stated Policies Scenario (STEPS), which reflects the IEA’s measured assessment of today’s policy frameworks and plans, and the Africa Case scenario, which reflects a more ambitious approach to economic transformation and meeting the SDGs. In each scenario, renewables electricity generation from wind and solar grows strongly by 2030. In contrast, the role of traditional biomass decreases as more modern sources are used to supply energy for cooking and heating in homes, businesses and industry. Overall the contribution from renewables to final energy consumption rises from 4.2% to 5.4% by 2030 in STEPS and nearly doubles to 8% in the Africa Case.

Improving progress on energy efficiency

Despite positive signals on energy access and renewables, progress on energy efficiency – SDG 7.3 – has been stagnant across North Africa. Instead of decreasing, the region’s combined energy intensity5 was 7% higher in 2018 than in 2000. By comparison, energy intensity has been decreasing in Africa and non-OECD countries. These results varied across the region, however, as some countries performed better than others. Energy intensity increased in Egypt and Algeria by 16% and 4% respectively between 2000 and 2017; it decreased in Tunisia by 7 %, in Morocco by 4 % and in Libya by 1% over the same period.

Energy efficiency is essential for North African countries to achieve sustainable economic growth ambitions while limiting energy demand. Growing the energy efficiency sector can create jobs, support economic development, increase the competitiveness and resilience of local industry, and improve energy affordability, while freeing up funds for other parts of the economy including health and education. Enhanced energy efficiency can reduce energy demand, and demand-side management will allow production capacity to be freed up, ensuring a more stable energy supply. In a region where intermittent renewable energy sources are growing, such as in North Africa, this will be key. The Africa Case shows that North Africa could be using up to 7% less energy (or 12 Mtoe) by 2030 if energy efficiency is increased. The main savings potentials are in the industry sector, accounting for almost half, followed by buildings (28%) and transport (19%).

In order to untap energy efficiency benefits, policy makers should combine a roll-out of regulatory, information and incentive measures. Policy packages based on measures and best-practice policy recommendations proven effective in other countries can bring about rapid and long-term positive results to unlock energy efficiency opportunities in North Africa. In order to support the mandatory aspect of the recommended policies, incentives can be used to overcome barriers such as increased costs. These can take different forms such as tax rebates, grants, public investment or bulk procurement. A variety of incentives to support efficient appliances, equipment and lighting purchases exist in the region, including tax exemptions for materials needed to manufacture energy-efficient products and access to finance in Egypt, and public buildings retrofits in Morocco. Strengthening these efforts, for example through government-led public procurement programmes, grants and subsidies for business and consumers as well as financing schemes for manufacturing would ensure a faster and more successful market transformation.

A changing role for hydrocarbons

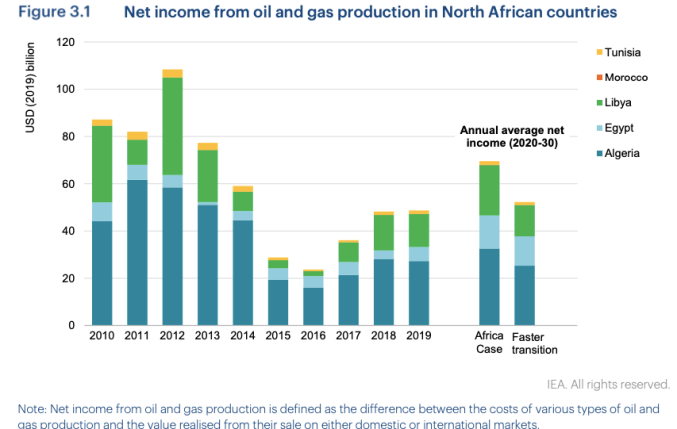

Oil and gas resources have long been a central element in the economic outlook for North African countries, notably Algeria, Egypt and Libya. As clean energy transitions accelerate, these countries are facing serious questions about their development models, which rely heavily on fossil fuels. Without fundamental changes, a long-term reduction in hydrocarbon income as a result of energy transitions would not only hamper the ability of governments to make the investments necessary to diversify their economies but could also limit their capacity to respond to any potential periods of economic disruption. Since demand and prices for oil and gas tend to be highly variable – as shown most recently during the Covid-19 pandemic – export revenues are subject to large swings, with knock-on effects for the economies. This volatile and unpredictable income tends to lead to high levels of public spending during boom times, followed by periods of severe fiscal strain during downturns. This cyclical dependence could undermine the effectiveness of government efforts to promote economic growth and achieve structural transformation. Growing global efforts to respond to climate change also pose major questions over the strength of long-term hydrocarbon demand. North African producers are increasingly heading towards a future where markets for their ample resources may not be guaranteed.

While achieving economic diversification requires broad-based efforts beyond the energy sector, developing an effective and transparent revenue management mechanism would be the first step to counter commodity price volatility and diversify revenue streams. Some countries are investing revenues into a range of financial assets for the wealth of future generations. Others set aside a specific portion of revenues during boom times to cover budgetary shortfalls during lean years. Other countries channel revenues towards domestic development of infrastructure and industry to lay the groundwork for economic diversification. Whichever pathway a country follows, the mechanism should include arrangements to ensure oversight and transparency of resource revenue flows and expenditure. Changing energy market dynamics suggest that fundamental changes to the development model of North African producers may be increasingly unavoidable, more so than at any other point in recent history.

The water–energy–food nexus: Opportunities for productive energy transitions

The complexity of the water–energy–food nexus is evident in North Africa. All five countries already face a high degree of water stress, and there is increased uncertainty about future water availability and the impact that climate change will have on water resources. Libya ranks as one of the most water-stressed countries in the world (WRI, 2019). Agriculture, made up mostly of small family farms, is a significant source of employment in the region and the largest user of water. Yet the region is also highly dependent on food imports, which account for 50% of their caloric consumption (AFDB, 2016). Total primary energy demand is dominated by oil and gas, which account for 43% (oil) and 51% (gas) of demand today. In the power sector, more than three-fourths of generation is natural gas-based. These challenges are all interrelated.

How this nexus is managed will have wide-reaching implications for the region’s ability to achieve the clean energy transition, meet its sustainable development objectives (notably SDG 2, SDG 6, SDG 7 and SDG 13) and ensure its resource security. If managed independently, these trends can strain countries’ social, economic and environmental systems, which can affect stability and development. An integrated approach can illuminate opportunities to improve resource efficiency, productivity and security, which may change the scale and type of the energy technologies deployed. When looking at roadmaps for clean energy transitions, it has become ever more important to understand the linkages among these sectors, to anticipate future stress points and to implement policies, technologies and practices that soundly address the associated risks.

Strengthening the climate resilience of energy systems

North African countries are among the most vulnerable regions to the potential impacts of climate change. The increasing impact of climate change shows the need to build up a reliable energy mix and improve the resilience of existing and new energy systems. Adequate investment in resilient energy systems and infrastructure for the region will be vital. Clean energy transitions in North Africa need to incorporate planning and investment decisions that ensure their energy systems are climate resilient and secure. The increasing share of renewables such as solar, hydro and wind to implement clean energy transitions in the region will require adoption of measures to enhance climate resilience, given that renewable energy technologies tend to be sensitive to a changing climate (Ligtvoet et al., 2015). For instance, rising global temperatures have moderate but negative impacts on solar panel performance (Peters and Buonassisi, 2019). Erratic rainfall patterns directly exacerbate variabilities in hydropower generation and changes in wind speed can alter wind potential and even damage wind turbines if they are associated with cyclones and storms (Evans et al., 2018).

Governments and utilities need to better understand these climate impacts on energy systems, and to take appropriate actions to enhance their resilience to the adverse effects of a changing climate. Without the support from governments, private actors could have a limited incentive to implement resilience measures, because the benefits of investment in resilient energy systems are likely to be seen only after a few years or even decades. However, if energy systems remain vulnerable to climate impacts, it will bring large costs to society, while energy service providers would bear only a fraction of the entire socio-economic cost. Thus, governments need to send strong signals to the private sector to encourage investment in building with climate change resilience in mind.

Impact of Covid-19 and the way forward

The Covid-19 pandemic triggered an unprecedented economic shock with profound implications for energy systems around the world. While first and foremost a global health crisis, related confinement measures have had major implications for global economies and their energy sectors. According to the African Development Bank, regional economic growth is expected to see a decline of between -0.8% and -2.3% for 2020, depending on how long the pandemic lasts. The energy sector was affected by plummeting demand, as populations went into confinement and restaurants, shopping malls and, in some countries, factories closed down to prevent the spread of the virus. Countries such as Egypt and Morocco saw a drop in electricity consumption – Egypt’s dropped by 12% and Morocco’s by 14% – with shifting demand loads, mostly moving towards residential use. While resilient overall, the region’s energy systems faced operational pressure from excess generation capacity. Another impact was that the economic crisis has made it difficult for some customers to pay their bills, reducing revenue for utilities. Some countries provided power for free, adding pressure on the financial health of utilities and state budgets.

The historical collapse in demand and prices took a heavy toll on oil and gas revenues for North African producer economies such as Algeria and Libya, which depend on hydrocarbon exports to maintain foreign currency reserves, pay salaries and provide essential services to their populations, especially health care, education and sanitation. The net oil and gas income in Algeria and Libya fell by some 75-90%, putting severe strains on these countries’ ability to counter the economic damages during the pandemic. Meanwhile, IEA data warn of a decrease in energy investments in North Africa for both oil and gas as well as for the electricity sector in 2020, with worrying implications for clean energy transitions and security. Countries now face tighter credit conditions in accessing finance given restricted fiscal space, as recent events brought a repricing of risk across the global economy and energy sector. Furthermore, reduced revenues further impact utilities’ ability to spend on expanding future generation capacity. This goes against the need to invest in energy systems of the future in terms of cleaner generation capacity as well as in resilient networks to carry growing energy demand of the future.

Despite the investment drop in 2020, maintaining energy investments at appropriate levels is key to ensuring the essential resilient energy systems of the future. Countries should prioritise investments in electricity generation capacity, power networks and also transmission, in order to guarantee the creation of energy systems that can support future economic growth. To that end, mobilising more capital towards low- carbon generation capacity and strengthening the transmission, distribution and grid infrastructure across North African countries are key. That will in turn require the continued strengthening of countries’ policy and regulatory environments. More than ever, policy signals will be critical to attract private-sector capital needed to bridge the clean energy investment gap, and regional collaboration will be key to realising energy transitions that can power the recovery.

The full report by IEA can be accessed by clicking here