Key enabling policies

Colombia is leading the transition to electric mobility in Latin America. The transition is on account of a clear national policy and laws that establish the framework required to meet decarbonisation goals. The country updated its Nationally Determined Contributions (NDC) towards mitigating the impact of climate change in December 2020 and has committed to achieving net zero emissions by 2050. In the updated NDC, Colombia has committed to greening its passenger vehicle fleet, with a cumulative target of getting 600,000 electric vehicles (EVs) on the road by 2030, a step that has a mitigation reduction potential of 4 MtCO2e, the most of any of the transport measures proposed so far. Colombia has also set targets for government fleets and for public transportation systems, and cities are required to increase their share of electric bus purchases from 10 per cent in 2025 to 100 per cent in 2035. In 2019, Colombia also passed a national law (levy 1964) offering tax and other incentives to promote EV ownership and usage. The country implemented a supportive procurement policy wherein tenders from 2020 onwards favour 100 per cent electric buses with 15-year-long contracts (instead of 10 years). All these factors have created market readiness for the adoption of electric buses.

Market potential

Bogota, the capital of Colombia, offers significant market potential for the adoption of electric buses. A study done under the Zero Emission Bus Rapid-Deployment Accelerator (ZEBRA) partnership highlighted that Bogota alone has a market potential of USD240 million in 2020–2022. With the policy directive for the deployment of a 100 per cent electric fleet by 2035, Bogota alone has a market potential of 8,000 buses operated by Bogota Sistema Integrado de Transporte Público (SITP).

Figure 1 highlights the market potential of pioneering cities in Latin America for the adoption of electric buses.

The study also concludes that the e-bus market offers a strong business case in Latin America. Bogota is structuring contracts with a set internal rate of return (IRR) for investors of 12 per cent as against the set IRR of <10 per cent for diesel buses. These IRRs are based on existing tariffs and subsidies; there is no impact on passengers.

Existing fleet status

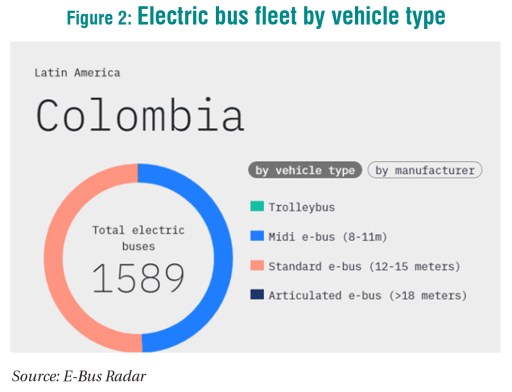

At present, Colombia has a total bus fleet of 1,589 electric buses. Figure 2 presents the distribution of vehicles by type and Figure 3 represents the distribution of vehicles by manufacturer. The majority of the existing e-buses are of the Midi type. The key bus manufacturer is the Chinese company BYD, with 1,546 buses. Currently, the bus fleet is only procured from this Chinese manufacturer. There is no local provider in the market. The electric bus fleet is operational in Bogota, Cali, and Medellin, with only 35 and 69 buses of the total fleet in the latter two cities.

Financing and investment

Public financing

- The e-bus market in Colombia has become lucrative for private investors. Strong public guarantees have helped investors enter the market. Public financing covers between 47 and 50 per cent of the capital cost and the remaining amount is covered by fares.

- In terms of public financing, the Inter-American Development Bank (IDB) will provide funding through loans for asset owners with government guarantees. Banco Estado and Corporación de Fomento de la Producción de Chile (CORFO) are also likely to finance initiatives in the electric mobility sector.

Private financing

- The ZEBRA partnership is financed and facilitated by P4G (Partnering for Green Growth and the Global Goals 2030) and co-led by the C40 Cities Climate Leadership Group and the International Council on Clean Transportation (ICCT). It has facilitated an investment of USD1 billion in funding from investors to deliver zero-emission buses in Latin America. The programme plans to deploy 3,000 buses in Colombia, Chile, and Brazil.

- Investor pledges have come from AMP Capital, ARC Global Fund, Ascendal, Ashmore, Copec Voltex, EDP Brasil, Enel X, John Laing, VEMO, and VGMobility. Specific to Colombia, Enel X, in partnership with Metbus, has invested USD40 million in 102 12-metre-long BYD buses, 100 chargers, and an additional 183 buses from BYD to fully electrify Corredor Grecia.

- Engie has invested in 100 Yutong ZK 6128 12-metre-long buses in partnership with two operators: STP Santiago (25 buses) and Buses Vule (75 buses).

- NEoT Capital, a French investment platform specialising in distributed renewable energy and electric mobility, has recently invested in 25 12-metre-long King Long e-buses in partnership with RedBusUrbano.

Business model

SITP has developed a business model for electric buses. The financing is shared by government funding agencies, private investors, operators, and special purpose vehicle/asset owners. The private investors provide debt or equity investment to the asset owner. The government provides the guarantee. The development finance institutions do not play a role currently, but may get involved in the future. The revenue collected through the fare box is centrally collected by the system fund trust and then distributed to the asset owner and the operators.

Figure 4 outlines the business model for electric buses adopted by SITP.

Way forward

Colombia is pioneering the shift to electric buses in Latin America by creating and facilitating a market-responsive environment for the uptake of the e-bus market. An enabling policy, an innovative financing model, government subsidy and guarantee, and incentive-based procurement have led to an attractive market. The innovative public–private partnership (PPP) model wherein asset ownership and asset operation are unbundled has led to the successful deployment of more than 1,500 buses. Under this model, fleet providers finance, procure, own, and maintain the equipment, and provide e-bus fleets to operators or to municipalities under stable long-term contracts. The distribution is, however, skewed across the country, as more than 90 per cent of the fleet is currently operating in Bogota. Columbia will need to ensure the speedy adoption of electric buses across its cities to be able to achieve 100 per cent e-buses by 2035.